TJSB Sahakari Bank 商業概覽

更多 TJSB Sahakari Bank。 訪問 https://www.tjsbbank.co.in/

業務亮點

tjsb credit card how to check tjsb account balance tjsb app

TJSB Sahakari Bank 商家信息

商家網站、聯繫電話以及禮品卡、購物卡資訊。 禮卡名稱 TJSB Sahakari Bank.

商家洞察

- NRE Non-resident Indians (NRIs) and Person of Indian Origin (PIOs) are permitted to open and maintain these accounts with authorised dealers and with banks ... https://tjsbbank.co.in/NRaccount-NRE

- Rupay Debit Card - TJSB Sahakari Bank Ltd. Once registered, in case of lost/stolen cards, you can block your card by simply giving a miss call on the number 9222892228 from your registered mobile number; Card Liability Insurance upto Rs.35,000/- *. Personalised / Insta-Cards (Non-personalised Cards) available. Card valid for transactions in INDIA only. https://tjsbbank.co.in/rupay-debit-card

- NRO Any person resident outside India may open NRO account with an authorised dealer or an authorised bank for the purpose of putting through bona fide ... https://tjsbbank.co.in/NRaccount-NRO

- Debit Cards - TJSB Sahakari Bank Ltd. Debit Cards. Home / Services / Debit Cards Rupay EMV Debit Card. Get your Rupay EMV Debit Card of Cash Limit of ₹ 25000 /-SMS Alerts 24x7 Service 2.5% Surcharge for the fuel transactions you make at all petrol stations. 3.5% markup for International Transactions. Zero Lost Card Liability Insurance : ... https://tjsbbank.co.in/debit-cards

- What is Verified By Visa? What is Verified By Visa? A. General Questions What is the Verified by Visa (VBV) service? Verified by Visa (VBV) is a service offered by TJSB and VISA. This service provides you to use password while using the card for internet/online payments. Register your Card to VBV Service and create your own password for making online payments. https://www.tjsbbank.co.in/pdf/visa/vbv-faq.pdf

- Goods and Services Tax (GST) - TJSB Sahakari Bank Ltd. GST will be a single destination based consumption tax that will replace existing taxes, including CENVAT, Octroi, Sales Tax, and Excise Duty, etc. Unlike the old tax structure, where the state of origin received tax revenue, in the new GST model the state in which goods and services are consumed is the state that will receive the revenue. https://www.tjsbbank.co.in/GST/

- Process for Re-carding / Replacement of Debit Cards Process for Re-carding / Replacement of Debit Cards As per RBI guidelines, Magnetic Stripe Debit Cards (i.e. Non-EMV Debit Cards) will not be operational from 1 st Jan 2019 onwards. Bank has already started the process of migrating Magnetic-Stripe Debit Cards to RuPay EMV Chip Debit Cards (Irrespective of Expiry Dates https://tjsbbank.co.in/pdf/FAQs%20for%20TJSB%20Site.pdf

- TJSB Letter of Credit - TJSB Sahakari Bank Ltd. Letter of credit is provided to meet need for trade purchases. These are generally provided for 3-6 months depending upon the customer’s trade cycle. Apart from this we provide letter of credit for importing machinery or capital goods. Such LC’s are for tenure ranging from 1-3 years depending upon the need of the borrower. https://tjsbbank.co.in/letter-of-credit

- Service Charges & Fees - TJSB Sahakari Bank Ltd. Particulars of Charges Charges; Up to Rs. 10,000 (per instrument) Min Rs. 100/-plus postage at actuals Rs. 10,000 to Rs. 1,00,000 (per instrument) https://tjsbbank.co.in/service-charges

- KYC - TJSB Sahakari Bank Ltd. Appeal to customers for updation of KYC documents. Dear Customer, We would like to invite your attention to the Reserve Bank of India guidelines on "Know Your Customers" (KYC) norms and obligations under PMLA 2002, which makes it mandatory for banks to periodically update records of the customer with latest information relating to their identity proof and address proof, e-mail ids, telephone ... https://tjsbbank.co.in/kyc

TJSB Sahakari Bank 禮卡餘額

你可以用一下方式查詢TJSB Sahakari Bank餘額:商家服務台或收款處。

禮卡餘額

禮品卡餘額檢查選項

禮品卡餘額查詢

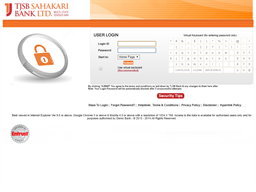

以下是 TJSB Sahakari Bank 查餘額以及消費記錄的方法.

查看收據小票

商家服務台

- 線上查詢

- 電話查詢

- 收據小票

- 服務台

禮品卡餘額洞察

- Rupay Offers Rupay Debit EMV Card · Rupay Platinum EMV Card · VISA EMV Platinum Debit card · EMV RuPay Debit .... Eligible customer proceeds to pay the balance amount 6. ..... It's compulsory to add Personalized Gift in your cart – to avail this offer. 5. https://tjsbbank.co.in/rupay-offers

TJSB Sahakari Bank 使用者評論

分享您的經驗 TJSB Sahakari Bank