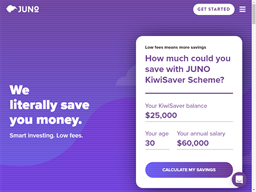

Kiwi Saver Visão geral do negócio

Mercante site info e Kiwi Saver cartão saldo cheque. https://www.junokiwisaver.co.nz

Destaques de negócios

Kiwi Saver Informações do comerciante

Site, número de contato e informações de cartão de presente para Kiwi Saver.

Informações do comerciante

- Pros and cons of credit cards | JUNO 1. Credit cards can tide you over until next pay day. Sometimes the unexpected happens, the car breaks down, or a relative gets sick overseas, and you’re faced with a huge expense, which you can pay instantly on a credit card. https://www.junokiwisaver.co.nz/learn-with-juno/article/pros-and-cons-of-credit-cards

- 5 money-saving hacks from a millennial | JUNO This one is a no-brainer, but it’s a hard habit to crack. Banks love helping uni students to sign up for credit cards and overdrafts. But interest rates are high, so not paying your balance off in full every month can be a slippery slope to a financial crisis. https://www.junokiwisaver.co.nz/learn-with-juno/article/5-money-saving-hacks-from-a-millennial

- The money-saving guide for coffee addicts | JUNO Cafes are starting to introduce prepaid coffee cards, where you purchase 10 coffees up front. ... They're a practical gift that will save you money. https://www.junokiwisaver.co.nz/you-money/you-money-article/the-money-saving-guide-for-coffee-addicts

- How to grow your KiwiSaver balance on your OE | JUNO Experts JUNO spoke to recommend paying off any high interest debt first while you’re living overseas. This includes credit cards or expensive hire purchase payments. If you have a student loan, you’ll start paying interest once you move overseas. This means your debt will grow. https://www.junokiwisaver.co.nz/learn-with-juno/article/how-to-grow-your-kiwisaver-balance-while-living-abroad

- KiwiSaver and money in your 50s | JUNO Fees eat into your hard-earned KiwiSaver money and reduce your balance. Check how much you’re paying in fees using the Sorted KiwiSaver Fund Finder and make sure you’re happy with what you’re paying. 4. See the experts . If you haven’t already, seeing a financial adviser in your 50s (and regularly after that) can put you in a great position to meet your money goals for the retirement ... https://www.junokiwisaver.co.nz/you-money/you-money-article/dont-hold-back-in-your-50s

- 50s and retirement saving | JUNO Jul 23, 2019 ... Make sure credit cards are fully paid at month-end, ... consider whether it'll be a gift, a loan, or if you'll become a guarantor, ... https://www.junokiwisaver.co.nz/you-money/you-money-article/im-in-my-50s-am-i-on-track-for-retirement

- Don''t save things for later | JUNO Notebooks and cards. How often do you send a handwritten note on a monogrammed paper? Food. Enjoy chocolates or boxes of biscuits while they’re fresh. Dried herbs and spices lose their flavour over time too. Books. They go out of date and are rarely re-read. Pass them on. Clothes. If you feel good wearing them, don’t save them for ‘best’. https://www.junokiwisaver.co.nz/learn-with-juno/article/dont-save-things-for-later-save-money-instead

- KiwiSaver and money in your 40s | JUNO Fees eat into your hard-earned KiwiSaver money and reduce your balance. Check how much you’re paying in fees using the Sorted KiwiSaver Fund Finder and make sure you’re happy with what you’re paying. 2. Get your protection in place . With hopefully a healthy pot of money building for retirement, you want to try your best to not lose it. Diversify your investments, check your insurance ... https://www.junokiwisaver.co.nz/you-money/you-money-article/accelerate-your-money-in-your-40s

- 6 reasons you’re broke, and how to fix it | JUNO Problem 5: You’re paying interest on credit cards and other personal loans. Paying interest is wasted money. Are you drowning in personal debt? How to fix it: Get a plan in place to reduce your debt, starting with by paying off the debt that has the highest interest. Money Talks is a free budgeting service that can help. https://www.junokiwisaver.co.nz/learn-with-juno/article/6-reasons-youre-broke-and-how-to-fix-it

- KiwiSaver and money in your 30s | JUNO Fees eat into your hard-earned KiwiSaver money and reduce your balance. Check how much you’re paying in fees using the Sorted KiwiSaver Fund Finder and make sure you’re happy with what you’re paying. 4. Your first home. If buying a house is one of your goals, put plans in place to get there. If you have a home already, think about how you can pay off the mortgage faster. Maybe it’s ... https://www.junokiwisaver.co.nz/you-money/you-money-article/get-ahead-in-your-30s

- KiwiSaver and money in your 20s | JUNO Fees eat into your hard-earned KiwiSaver money and reduce your balance. Check how much you’re paying in fees using the Sorted KiwiSaver Fund Finder and make sure you’re happy with what you’re paying. 3. Start a savings account. If you don’t have any savings, now’s a good time to start. Having some money in an emergency fund for any unexpected expenses can reduce stress. Aim to build ... https://www.junokiwisaver.co.nz/you-money/you-money-article/make-the-most-of-your-20s

- How to work towards financial freedom in your 30s | JUNO Having high-interest debt, such as credit cards or payday loans, can be stressful. Repaying money month after month can make it really hard to break the cycle of debt, making it really hard to get ahead. We’ve already talked about tackling your student loan. https://www.junokiwisaver.co.nz/learn-with-juno/article/how-to-get-rich-in-your-30s

- Why you shouldn’t neglect KiwiSaver when you’re overseas Glasgow says it’s important to pay off any high-interest debt, like credit cards, before you contribute to your KiwiSaver account. Also, make sure you’re keeping on top of the minimum repayments on your student loan, if you have one, he says. https://www.junokiwisaver.co.nz/learn-with-juno/article/why-you-shouldnt-neglect-your-kiwisaver-when-youre-on-an-oe

- 6 ways to cut down on fuel costs - junokiwisaver.co.nz Using Fly Buys cards and AA Smartfuel cards at the pump gives you at least 6c a litre off. Add supermarket specials and discounts can be up to 40c a litre. On Gaspy, use the ‘Discounts’ feature to recalculate your cheapest rate based on Fly Buys, supermarket dockets, or other loyalty cards. https://www.junokiwisaver.co.nz/learn-with-juno/article/6-ways-to-cut-down-on-fuel-costs

Kiwi Saver Cartão de presente

Kiwi Saver presente cartão ou vale-presente links. Maneira conveniente para gerenciar equilíbrio na mosca em GCB app móvel

Programa de vale-presente

Links de vale-presente

Página de web de cartão presente, termos e condições para Kiwi Saver.

Informações sobre cartões-presente

- All Articles - JUNO KiwiSaver Scheme What's the average student loan balance? christmas ... Homemade Christmas gifts that aren't tacky. power bill.jpg ... Pros and cons of credit cards. get out of ... https://www.junokiwisaver.co.nz/learn-with-juno/all-articles?filter=money-saving+tips

Kiwi Saver Saldo do cartão presente

Você pode descobrir o saldo do cartão Kiwi Saver por verificar saldo on-line, visita loja contador / balcão.

Saldo do cartão presente

Opções de verificação de saldo do vale-presente

Consulta de Saldo do Vale-Presente

Informações para Kiwi Saver inquérito de saldo de cartão presente para ver o saldo e transações restantes.

- Saldo on-line: Siga o link para o site de verificação de saldo oficial do comerciante. Você precisará preencher o número do cartão e o pin a fim de recuperar o saldo do cartão.

- Ligação: ligar do comerciante suporte número e fornece dados do cartão, você será capaz de obter o equilíbrio no telefone.

- Factura / recibo: o saldo remanescente do cartão está impresso na factura comercial / recibo.

- Balcão de loja: geralmente o saldo do cartão poderia ser pesquisado no balcão de loja ou a loja

Informações sobre o saldo do vale-presente

- The power of compound interest | JUNO By the end of Year 1, your credit card balance has gone up to $11,995, an extra $1,995 even though you didn’t make any additional purchases. How quickly will this go up? Have a look what happens by the end of Year 5 (again assuming you make no repayments). Although you only borrowed $10,000 using your credit card, by the end of year 5, you owe $24,831.40. Not fair right? What is even more ... https://www.junokiwisaver.co.nz/you-money/you-money-article/the-power-of-compound-interest

- 11 financial resolutions for the new year | JUNO Put a plan in place to reduce any bad debt, for example, credit cards or high cost debt such as payday loans. An out-of-control credit card balance could hinder your financial future. 2. Focus on savings. Aim to put away 5-10 per cent of your income into an untouchable savings account. https://www.junokiwisaver.co.nz/learn-with-juno/article/11-financial-resolutions-for-the-new-year

- How much should I put into KiwiSaver? | JUNO If you have consumer debt, like a credit-card balance or personal loan to pay off, tackle this first before increasing your KiwiSaver contributions. That’s because on consumer debt, you’re likely to be charged an interest rate higher than the rate of return you’d reasonably expect on your KiwiSaver. So reducing your debt is actually a better investment than KiwiSaver. Have an emergency ... https://www.junokiwisaver.co.nz/you-money/you-money-article/how-much-should-i-put-into-kiwisaver

- How to get out of debt | JUNO Debt has become part of everyday life. Many of us start borrowing at university with a student loan, or buy our first car, and then just get used to having overdrafts, credit card balances and personal loans. https://www.junokiwisaver.co.nz/learn-with-juno/article/how-to-get-out-of-debt

Kiwi Saver Avaliação do usuário

App de saldo de cartão presente

- Viver o saldo do cartão de comerciante de cartão

- Número do cartão não mais tendencioso digitar cada vez

- Opções de consulta de saldo em um relance